Car Loan Repayment Calculator

Your Car Loan Repayment Calculator Guide

Homes are usually considered the biggest financial burden anyone can have. But there is one more that can cost about the same, if not more.

And it’s none other than a car. Cars don’t come cheap; in fact, they’re probably the most expensive piece of machine anyone can buy.

That’s why most families acquire one through a loan. So, in this guide below, we’ll discuss how to use our car loan repayment calculator and other things related to this.

What is a Car Loan Repayment Calculator?

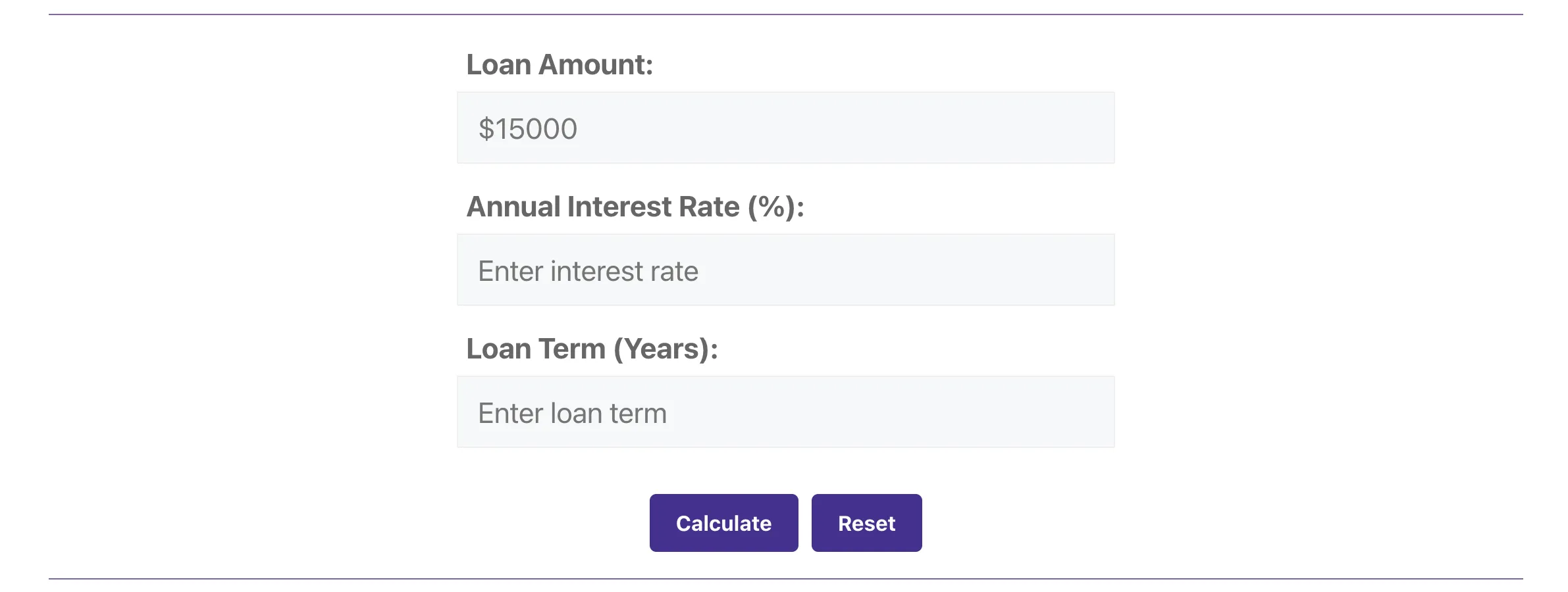

The car loan repayment calculator is a minimalistic website that allows you to calculate your total amount payable based on interest and the period.

Still, it doesn’t limit you to just cars. Any form of long-term loan can be checked here with just a few clicks.

Why is a Car Loan Repayment Calculator Important?

While taking a massive financial burden like a Car, it’s wise to check how much you’ll pay at the end of your term.

There are multiple car loan agents, and most of them have a different range of interest rates depending on the term.

You can use our car loan repayment calculator to know the final amount. After that, you can decide which one fits your bill based on your budget.

The Pros Of Using Our Car Loan Repayment Calculator

There are many advantages to using our car loan repayment calculator over any other known ones like Edmunds.

- Clutter-free UI: Our car loan repayment calculator only has the necessary fields to fill. No extra junk that might distract you from your end result.

- Reliable: Our car loan repayment calculator is online 24/7 and 365 days a year. Want a quick lookup? Just type the numbers and see the magic!

- Blazing Fast: Our repayment calculator for car loans shows you the result in milliseconds. The website is free of junk, so only the required parts are shown to you.

- Easy Reset: The integrated Reset button makes it easier to fix any typo in seconds.

- One Page: Everything happens on a single page. No new windows will open, nor will you be redirected anywhere else. This is also the main reason why everything loads crazy fast.

These are only a few of the many pros this website has. The biggest selling point is its minimalistic design that doesn’t distract you from your main task at hand.

How to Use Our Car Loan Repayment Calculator?

Using our car loan repayment calculator is as simple as it can get. All you have to do is fill these three boxes:

- Loan Amount: the principal amount of your car loan.

- Annual Interest Rate (%): Interest rate based on your tenure.

- Loan Term (Years): Loan period in years.

After filling those boxes, all you need to do is press calculate. Then you’ll see a new section that’ll indicate Monthly EMI, Total Interest, and Total Amount.

Monthly EMI, well, it is what it sounds like—the monthly amount that you’ll pay during your term. While the Total Interest and Total Amount indicate how much interest and amount you’ll pay at the end of the term.

Alternatives of a Car Loan Repayment Calculator

In any case, you don’t even need to visit any website just to calculate your interest. Most modern phones already come with a calculator.

For example, the Mi calculator from Xiaomi. It has a dedicated section for finance, which offers you three fields, similar to our car loan repayment calculator.

Fill in the blanks, and Wallah! It shows you the exact same numbers. And do you know the fun part? You can click on stats, and it gives you two dedicated pages.

Only one shows interest and principal dedication per month, and the other one shows the same thing but per year. This way you can see your loan balance getting depleted month by month, which also means your interest will go down and down and down.

Understanding Your Loan Repayment Results

Loans have three crucial parts to them: the first is the principal, the second is interest, and the third is your final pay. Our new car loan repayment calculator simplifies all that in three parts:

- Monthly EMI: It includes a sum of your principal amount and interest rate. The principal amount will be recovered, and as a result, your interest will also get shorter.

- Although it won’t be reflected on your monthly EMI, nor will you pay less.

- The monthly EMI is fixed throughout the tenure or term of your loan.

- Total interest: Interest is calculated monthly based on your total amount. While Total Interest adds all monthly interest and presents you with a solid number.

- Total Amount: This is the final amount you’ll pay throughout your term. This includes your principal amount plus your total interest.

Factors That Affect Car Loan Repayments

The loan repayment is affected by three things: the amount you take in, the principal amount, the rate of interest, and the term or tenure.

Different vendors will have different interest rates, but that doesn’t guarantee you’ll pay any less if the total term is 15 years.

That’s why make sure to have a talk with your family and friends and ask them what would be the best choice in these kinds of situations.

In most cases, you’ll want to go for a reasonable interest rate with the smallest tenure possible. You can even settle monthly EMIs in advance, which will give you some breathing time.

Common Questions About Car Loan Repayments

What is the ideal loan term?

One to three years is the best term for a car loan.

How do extra payments affect my loan?

Extra or advanced payments will result in a smaller tenure. It’ll also affect your monthly EMI.

What happens if I refinance my car loan?

Refinancing is a smart choice if you feel like you can have a better term with a different vendor. It gives you the freedom to reduce your interest rate and re-evaluate your total amount.

Can I reduce my interest rate mid-term?

Yes, you can, by payment Extra. Advance payment reduces your total amount, which will directly affect how much EMI you’ll pay.

How do I calculate car loan repayment?

You can calculate your car loan by visiting our website. Alternatively, you can also use calculator apps that provide a dedication section for finance.

Tips to Reduce Your Car Loan Repayment Burden

Here are a few tips to lessen your financial burden on a car loan:

- Always opt for advanced settlement or extra payments.

- Choose a shorter term.

- Choose your vendor wisely.

- Refinance if you find a better vendor.

- Take advice from friends and folks who have experience taking car loans.

- Choose a smaller loan amount.

- Make a down payment, or

- Trade in your old car instead.

Remember that loans are never easy. It’ll surely put up a burden, and there is no way to lessen the pain once the tenure starts. You may lose your job, but the loan must go on!

Mistakes to Avoid When Taking a Car Loan

Mistakes can happen. It can be negligible for the most part, but in the case of car loans, it takes a whole other level. That’s why make sure you consider these things:

- Double-check your interest rate.

- Get a clear clarification of any additional charges that might occur.

- Do not go through a middleman. Always do it personally or through an online method. Agents take commission, and it’ll affect your overall pay.

- Never bite more than you can chew. Only take the necessary amount that you can uphold. The company will take legal action against you if you fail to pay, and in most cases, it can result in penalties.

- Make sure to pay EMIs on time. Foreclosure fees exist, and they’ll add up over time, resulting in the biggest total amount than you might have anticipated.

- Don’t wait for next month; pay now! If you get the cash, then pay it in advance. This doesn’t only reduce your final pay but also gives you breathing room for the future.

- Refinance immediately if you find a better term. Usually, people get skeptical about this, but instead, they should immediately move forward if any good lender catches your eye.

- Never go for a longer term. A big term like 10 years will result in almost double if not more than your principal amount. In those cases, hold up your plan for a few years and only opt for it when you have total confidence.

How Our Car Loan Repayments Calculator Can Empower You

Our car loan repayments calculator gives you the freedom to check your total pay before you can even buy the loan.

It’s simple and easy to use. The interface takes you straight to your result. That way you can quickly see how much you’ll pay and rethink your plans.

The reset button again makes it easier to refill the boxes with new dentures or interest rates. In short, if all you need is a quick and reliable way of checking how much you’ll pay, then this is the right place.